|

Getting your Trinity Audio player ready...

|

By Kirsten Pearson

One unique feature of public finance is the concept of lapsing funds. Any unspent government funds at the end of a financial year must be returned to the treasury. This makes perfect sense. If government is borrowing money to fund its programmes, why leave funds idle while paying interest on loans?

But this creates a ‘use it or lose it’ situation.

Government departments often worry that underspending against their budget allocation will signal lower spending needs, leading to a decrease in their budget for the following year. This fear can trigger a phenomenon known as year-end spending surges. A negative consequence of this is that when departments scramble to spend their entire allocation before the year-end deadline, they sometimes resort to rushed or unnecessary purchases to avoid losing the funds.

Mark Twain, known for his wit, famously twisted the adage “Never leave that till tomorrow which you can do today” into the procrastinator’s version: “Never put off till tomorrow what you can do the day after tomorrow.” We had a look at procurement data to see what it could tell us about spending surges – or put another way – whether we could find signs of procrastination by government departments.

Flurry of contracts

The signs of year-end spending surges can be seen in procurement data in the form of a spike in contract initiations. Departments might initiate a flurry of new contracts near the year-end, potentially bypassing proper planning or vetting processes.

Organs of state are permitted, in some limited situations, to deviate from the standard procurement procedures. These exceptions are outlined in the Public Finance Management Act Treasury Regulations for national and provincial government entities. The reason that we chose to look at deviations is because using the open bidding procedure is generally preferable to using deviations. Excessive reliance on deviations can indicate that a department has neglected to plan and manage its procurement well.

The accounting officer or authority must approve reasons for deviations and report them to the treasury and Auditor-General within 14 days of procurement finalisation. The financial year for national departments and their entities runs from 1 April to 31 March.

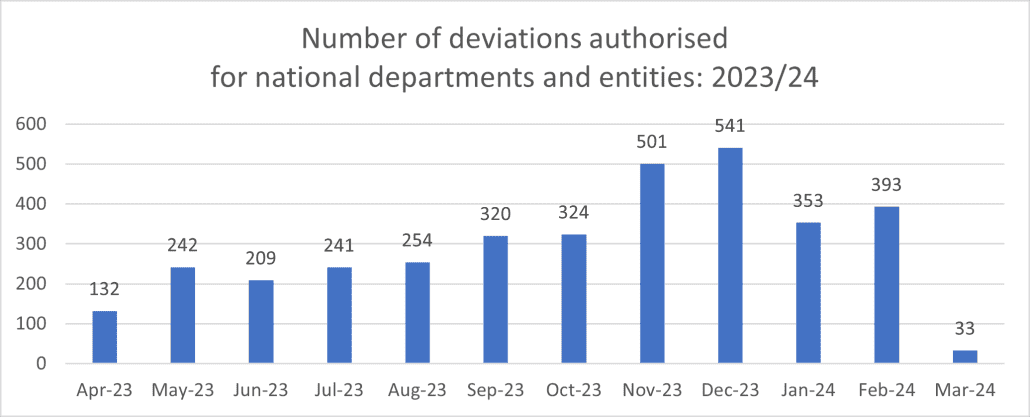

In the analysis below we can see a surge in the authorisation of deviations for national departments and their entities during November and December 2023. There are also smaller surges in January and February 2024 and September/October 2023. Unfortunately, we do not have the spending data per month to accompany the data for the deviations authorised. This analysis seems to suggest that if spending data were analysed, a spending surge would follow the spikes in the award of contracts.

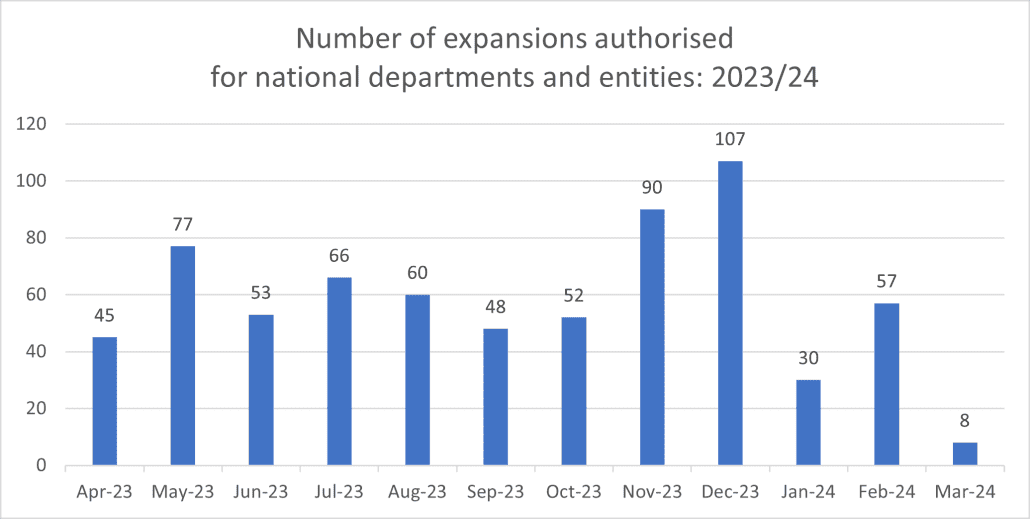

A similar spike in authorisations emerges when looking at expansions. Expansions entail expanding the contract value or time duration of an existing contract. The spike for expansions being authorised is also in November and December 2023.

In other words, based on our analysis, it appears that there is a trend of some officials procrastinating and then waking up late in the year to the reality that they need to spend the funds and opting for deviations and expansions to do so.

The drawbacks of year-end spending surges

Several challenges are immediately apparent:

- Inefficient allocation: Resources might be directed towards low-priority projects simply to meet spending targets, rather than being allocated strategically based on actual needs.

- Poor procurement: The pressure to spend quickly can lead to bypassing proper procurement procedures, potentially resulting in overpriced or unsuitable goods and services.

- Wasted resources: Purchases made solely to meet spending targets might not be well-planned or sustainable, leading to wasted resources and potential future problems.

Ensuring responsible use of public funds while also empowering departments to manage their budgets effectively is crucial for achieving optimal outcomes.

By analysing procurement data and identifying these patterns, we can work towards a more responsible and effective use of public funds. The goal is to move away from a system that rewards last-minute scrambling and instead empower departments to make informed decisions throughout the year, ultimately delivering better value for taxpayers.