|

Getting your Trinity Audio player ready...

|

A report released in mid-March 2023 by the Tax Justice Network (TJN) shows a slow but steady implementation of beneficial ownership transparency (BOT) regulations across the African continent. Titled Beneficial Ownership Transparency in Africa in 2022, the report reveals the state of play of the introduction of laws addressing the lack of BOT, and examines the commitments of African countries to BOT.

“It delves more deeply into the 18 African jurisdictions covered by the Tax Justice Network’s Financial Secrecy Index 2022. This includes assessing who has to register, when they have to register, and if the public has access to information on the real owners of companies.”

South Africa is one of those jurisdictions assessed under the Financial Secrecy Index.

Download the TJN report:

Beneficial Ownership in Africa in 2022

The TJN report particularly focuses on companies and also weighs the risks each country’s registration level poses, based on the number of legal vehicles registered in the country. A legal vehicle can be a company, partnership, trust, or foundation, and it can do business in the economy, open bank accounts, hold real estate, and provide goods and services.

“In summary, the report shows that the world is galloping towards beneficial ownership transparency.”

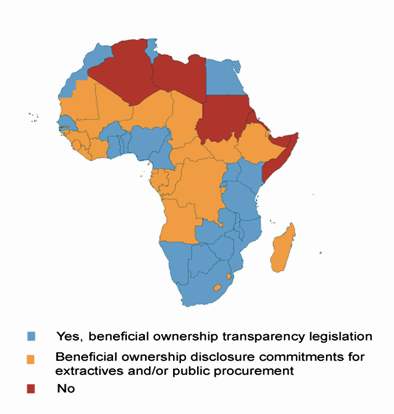

At the start of 2023, the report notes, 23 of 54 African countries have in place laws and regulations requiring the real people – the beneficial owners – behind legal vehicles to disclose themselves to a government authority. This is an essential tool in the arsenal against illicit financial flows, which cost the continent billions each year in lost funds for development. It also is a vital component of strategies to combat tax abuse, money laundering, corruption, and the financing of terrorism.

Lack of BOT also undoubtedly helped unscrupulous companies and the politically connected loot South Africa during the state capture era and later, during the emergency procurement regulations introduced as a response to the Covid-19 pandemic.

But there is a ray of light.

“More than half of the continent has committed to publicly disclose the beneficial owners in sectors prone to corruption and fraud: public procurement and the extractive industries.

“Governments in 28 African countries committed to disclose and make public the beneficial owners of companies in mining, oil and gas as part of the Extractive Industries Transparency Initiative (EITI).”

Historically, multinationals have scrambled to loot Africa of its natural resources, with the help of complex opaque and complex company structures behind which they obtain extraction permits and rights.

“In many countries, commitments to beneficial ownership transparency first made in the extractive industries have also sparked the introduction of laws for all companies in every sector.”

Source: Beneficial Ownership Transparency in Africa in 2022 (TJN)

Implementation of and adherence to EITI standards is a Corruption Watch focus area. The organisation has done extensive work around this matter and in November 2022 released two research reports, titled Beneficial Ownership Transparency in South Africa’s mining sector and The Extractive Industries Transparency Initiative and South Africa, respectively. The reports advance the case for greater BOT in the mining sector by implementing an effective regime and by becoming a, EITI member.

Transparency in public procurement is another particular focus area for Corruption Watch. To this end the organisation has developed a digital tool, Procurement Watch, to facilitate monitoring of government contracts with particular regard to deviations and expansions. It also monitors the two databases of restricted and debarred suppliers.

The report also features case studies from Cameroon, Kenya, Liberia, and Senegal.

The current situation

African nations are required to comply with the Financial Action Task Force’s (FATF) recommendations 24 and 25, which are recognised as global anti-money laundering standards, and which have robust beneficial ownership disclosure requirements.

There are still loopholes in these global standards, the report notes, but the FATF is working on tightening them.

African governments have also committed to greater beneficial ownership transparency in specific sectors. Besides the 28 countries which are working on EITI standards, the report says, 34 countries have committed to publish the beneficial owners of companies awarded government contracts. This links to accessing financing from the International Monetary Fund (IMF) for Covid-19 pandemic-related spending. Such financing could be accessed through rapid credit facilities, or rapid financing instruments, or regular IMF-supported programmes.

At the time of data collection, South Africa and several other jurisdictions did not regulate the registration of beneficial owners for any legal entity with a government authority. The country and Cameroon have since introduced legislation requiring the registration of beneficial owners with a government authority. In South Africa this is provided for in section 58 of the General Laws Amendment Act which amends the Companies Act. Companies must file a record with the Companies and Intellectual Property Commission for the individuals who are the beneficial owners of the company, and must ensure that this information is updated.

The General Laws amendment act comes into full force on 1 April 2023. Some sections were enforced in December 2022, but the sections pertaining to beneficial ownership disclosure are among those which come into force on 1 April.

Why is beneficial ownership transparency important?

Beneficial ownership transparency reveals the actual human beings, or natural persons, who own, control, or benefit from a legal vehicle.

They often differ from legal owners because the while latter may be the direct owner on paper, they may not be the beneficial owner. A legal owner may be a natural person such as a nominee shareholder, or another legal vehicle. In an ideal world the legal owner on paper will be the person who “genuinely owns the vehicle, who benefits from it and exerts some control over it”.

But often this is not the case, and just as often there is a nefarious reason – to hide the real owner’s identity. The beneficial owner can do this by appointing a nominee shareholder or another legal vehicle as the ostensible legal owner on paper, but in reality they will retain control of the vehicle and reap the rewards of its operations.

In South Africa, the as yet unresolved Digital Vibes scandal was just one of many cases that showed the importance of BOT. During the Covid-19 lockdown, the digital marketing company was hired by the national Department of Health (NDOH) to handle communications for the NDOH’s National Health Insurance media campaign, and was later also tasked with working on the department’s Covid-19 campaigns.

At the time of the tender award Digital Vibes was seemingly owned by Radha Hariram, who was later unmasked as a petrol station employee. A Special Investigating Unit report released in late 2021 indicated that the real owners were Tahera Mather and Naadhira Mitha, who were ‘close associates’ of then health minister Zweli Mkhize, and that Digital Vibes was merely a front for the pair.

“Furthermore, Digital Vibes (‘owned’ by Ms Hariram), Ms Hariram (in her personal capacity), Ms Mather and Ms Mitha (at the instance of the Minister), contravened the provisions of section 2 of the POCA (money laundering).”

To date, there have been no consequences for those implicated – no high-profile arrests, no prosecutions.

By naming Hariram as the owner of the company, Mitha and Mather masked their roles as the beneficial owners of the company. This is a common ploy and it serves to make it difficult for authorities to ensure the legal vehicle is not being used for illicit financial activity.

Beneficial owners may be hidden behind long ownership chains, says the TJN report, where one legal vehicle is owned by another which is owned by another. Such a chain may extend across multiple jurisdictions, where each legal vehicle in the chain is located in a different jurisdiction.

“The longer the chain and the more jurisdictions it spans, the harder it becomes to work out who controls each layer of legal vehicles and to identify the real owner at the top of the chain.”

BOT measures, the TJN report says, are therefore about requiring legal vehicles to disclose the natural persons who truly own, control or benefit from them, so that the onus is not on government authorities, banks, businesses, and the public to attempt to investigate and identify a legal vehicle’s beneficial owners.

“Effective measures make long and complex ownership chains, and other methods beneficial owners use to hide their traces of their ownership, redundant. By eliminating financial secrecy, beneficial ownership transparency restricts the manoeuvring space for illicit financial activity.”